Making Sense of Your Customer and Market Insights

- Chris Burgess

- Oct 17, 2025

- 6 min read

Updated: Nov 8, 2025

Gathering customer and market insights is easy; turning those insights into confident decisions that drives growth is the real challenge.

Every company I speak with tells me a similar story. Some have too much data, others

have too little, but nearly all struggle to turn what they have into clear direction. Data comes from loads of different sources including customer surveys, CRM notes, support tickets, analytics dashboards, call transcripts, win-loss analysis, and competitor updates: each tell part of the story, but rarely the same one.

The problem is not collecting insight. It is connecting it.

The widening gap between information and understanding

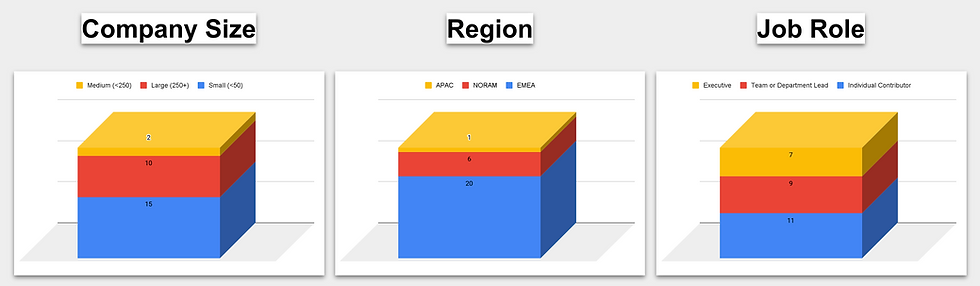

In my conversations with twenty-seven product and business leaders across Europe and North America, almost four out of five said they are collecting more customer or market data than they were a year ago. Yet fewer than half felt confident using it to guide decisions.

Larger organisations described fragmentation, with data scattered across multiple systems and owned by different departments. Smaller and mid-sized teams explained that they lacked a clear structure for capturing and revisiting customer input. This was not simply a question of company size, but of how insight work is managed. Incomplete understanding came up again and again as the central challenge.

Almost three-quarters of the people I spoke with said they rely on second-hand summaries of customer feedback instead of speaking to customers themselves. The result is a widening disconnect between what customers are saying and what companies believe they need.

Artificial intelligence is making collection easier, but interpretation is still not trusted. Automation can gather data faster, yet turning that data into trusted insight still depends on people. The more data companies collect, the more they realise that the real challenge lies in having the human time and empathy to make sense of it. Across every conversation, I’ve heard similar frustrations about why this gap persists and what gets in the way of understanding.

Why are insights and understanding disconnected?

Across all these conversations, three patterns kept surfacing.

1) Fragmentation.

Customer and market information lives in different tools because it enters the business through different channels. Sales uses the CRM, support uses ticketing systems, and product uses research repositories. In my research, nearly three-quarters of participants said their data spans multiple systems or documents, often owned by different teams. When everyone is working from a different dataset, opportunities are missed or rediscovered months later. The most effective teams close this gap by combining what customers say with what the market shows.

2) Capacity.

Sixty percent of leaders said their teams do not have time to analyse the information they already collect. This is not because teams are inefficient. It is because interpretation requires a human with sustained focus, and that focus is constantly interrupted by the operational demands of shipping product. Automation captures data faster than ever, but making sense of it still requires human judgement, and there are only so many hours in the day.

3) Confidence.

Even when insights exist, decisions feel uncertain. As one VP of Product in North America put it, “It takes hours to make sense of a single customer interview, and by the time we do, the next one is waiting.” Without a clear view of patterns across all feedback, teams cannot distinguish signal from noise. Every data point feels equally important, so none of them do.

These patterns reveal something deeper than process problems. Collecting the data is not the issue. In startups, sales or founders often collect the insights and hand them off. In larger organisations, product or research teams conduct customer interviews while other departments gather operational data, sometime product doesn't talk to the customer, that's the job of sales and customer support. The real question is who connects all these dots. Who has the time, the focus, and the confidence to look across every data point and make sense of what it all means?

When no one owns this, insight work becomes something people fit in between everything else. The result is familiar in companies of every size: feedback keeps coming in faster than teams can make sense of it, and opportunities slip through the cracks.

What effective teams do differently

The most effective teams I have seen treat customer and market insight as a strategic discipline, not an operational task. They create simple systems that make feedback patterns visible, identify the few signals that truly matter, and connect them directly to growth decisions. That kind of structured product thinking is what I explore further in One Product, Many Customers, which shows how clarity and structure help teams scale without losing focus.

But even with the right structure, one constraint always remains: time. Analysing qualitative data requires sustained human focus, the kind that is constantly interrupted by the demands of shipping product. You can have strong systems and clear ownership, but if analysis still takes days, decisions slow down.

I’ve been exploring whether AI can help teams make sense of insights faster while keeping people at the centre of the process. The goal is not to replace human understanding but to remove the repetition that slows it down. To test this, I’ve been building an AI workflow that brings together scattered customer and market data. It works like a small team of specialists: each agent focuses on one task, either gathering, cleaning, analysing, or summarising information, and then passes its work to the next. The final agent brings everything together in a simple interface that highlights emerging themes, contradictions, and opportunities.

Each part of the system uses the language model best suited to its task, whether that is OpenAI, Anthropic, or Google. This mix allows the workflow to mirror how human teams collaborate across different disciplines. It also keeps the analysis transparent and easier to adjust when something feels off.

Making sense of fragmented data faster

I am currently looking for companies to pilot this system over a two-week period. The pilot is for founders, heads of product, or product strategists who collect customer feedback but find it difficult to bring scattered insights together into a clear picture of what really matters.

The goal of the pilot is to test whether AI can reveal meaningful trends and patterns across disconnected sources of customer and market data. This is not about summarising feedback; it is about connecting it. The system is not yet a self-service product, so you will share your data with me and I will run it through the workflow. I am happy to sign an NDA to ensure confidentiality.

This is a collaborative process rather than a one-off analysis. Over the two weeks, I will adjust the workflow based on your feedback until the outputs reveal the insights you need.

I am starting with a small number of pilots so that I can work closely with each company and refine the approach. The results of this work will determine whether I pursue this as a full product. If I do, my next step will be to invest in an LLM setup that runs privately rather than through public servers.

Joining now means you will help shape that decision and be among the first to see what this kind of AI analysis can uncover in real customer data. Participants will also be contributing to potentially one of the most practical uses of AI in business innovation today, proving that AI can accelerate understanding without replacing human judgement.

Pilot participants will receive:

AI-generated analysis of your customer and market data, identifying themes and patterns across fragmented sources.

Collaborative sessions where we review the outputs together and refine the approach for your specific context.

Recommendations showing how to apply these insights to your roadmap.

To make sure the pilot is successful, I need someone dedicated to work closely with me over the two weeks, since the value of this process depends on collaboration. Together, we will refine the workflow until the outputs reveal the insights you need.

If this sounds useful, reach out at info@crwburgess.com with a short description of where your customer data lives today and what decisions you are trying to make with it. I will respond within 48 hours to let you know whether it is a good match for the pilot.

If you’d like more context on the value proposition, you can read the overview here.

Comments